Voluntary Renewable Power Procurement

NLR has tracked the voluntary renewable power market since its inception in the 1990s to help corporate purchasers, utilities, and others selling renewable energy products understand available renewable options and move renewable energy forward.

Voluntary renewable power is separate from renewables used to meet state renewable portfolio standards. View visualizations of NLR's voluntary renewable power market data over time. View U.S. voluntary renewable power market data for 2024.

Utility-scale renewable energy project deployment depends on the availability of up-front capital. NLR examined the role of long-term contracting for utility-scale wind and solar energy projects in the United States. Unlike previous studies that primarily focused on supply-side factors, this analysis focused on demand.

The study specifically assessed potential demand from S&P 500 corporations to enter into power purchase agreements for renewable energy in the United States, alongside demand from utilities driven by state renewable portfolio standards and voluntary climate pledges. NLR estimated demand by identifying common characteristics among existing off-site renewable energy owner purchase agreements buyers, including their credit rating.

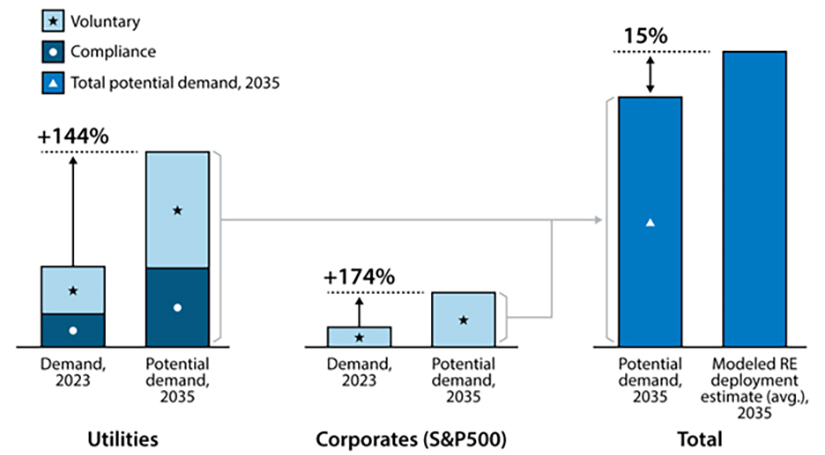

NLR found that potential corporate demand could reach as much as 358 terawatt-hours by 2024. In addition to corporate buyers, utilities could contribute significantly to future demand through state mandates and voluntary climate pledges. Importantly, the analysis suggests that demand from corporate and utility offtakers—entities that agree to purchase power from renewable energy projects—may act as a constraint on renewable deployment, in addition to supply-side barriers.

The findings indicate that while utilities remain a dominant source of demand for renewables, corporate demand is growing. Meeting mid-case deployment scenarios for renewable energy by 2035 will require utilities to meet their mandated and voluntary demands, along with sustained corporate demand growth of at least 11% per year.

U.S. Renewables Demand (TWh)

NLR has evaluated utility renewable pricing programs and published 2023 rankings. The 2023 and previous annual rankings provide assessments of utility renewable pricing programs in terms of renewable pricing customers and sales as well as the percentage of renewable pricing customers and the percentage of renewable power sales.

In 2024, about 9.2 million customers procured approximately 315 million MWh of renewable energy through renewable power markets. The report covers trends in utility renewable pricing programs, utility renewable contracts, competitive suppliers, unbundled renewable energy certificates, community choice aggregations, and power purchase agreements

NLR has developed a comprehensive list of renewable energy procurement options available by utility and municipality nationwide. NLR has also developed a separate list of active utility renewable pricing programs with more detailed information on these programs. To NLR's knowledge, these lists identify all active procurement options or renewable pricing programs nationwide. We welcome your input; if you see that a program is missing or inaccurate, please contact Sushmita Jena.

Featured Publications

2024 report slides | 2024 databook

2023 report slides | 2023 report | 2023 databook

2022 report slides | 2022 report | 2022 databook

2021 report slides | 2021 report | 2021 databook

2020 report slides | 2020 databook

2019 report slides | 2019 databook

2018 report slides | 2018 databook

2017 report slides | 2017 report | 2017 databook

The Geography of Green Power, NLR Fact Sheet (2018)

Existing and Potential Corporate Off-Site Renewable Procurement in the Southeast, NLR Technical Report (2019)

State summaries are available for Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina, and Tennessee.

Community Choice Aggregation: Challenges, Opportunities, and Impacts on Renewable Energy Markets, NLR Technical Report (2019)

Charting the Emergence of Corporate Procurement of Utility-Scale PV, NLR Technical Report (2017)

[presentation and summary]

Policies for Enabling Corporate Sourcing of Renewable Energy Internationally: A 21st Century Power Partnership Report, NLR Technical Report (2017)

[21st Century Report summary]

Renewable Electricity Use by the U.S. Information and Communication Technology Industry, NLR Technical Report (2015)

Contact

Share

Last Updated Jan. 6, 2026