The 2025 U.S. Geothermal Market Report delivers an in-depth update on the state of geothermal energy in the United States by expanding on the 2021 U.S. Geothermal Power Production and District Heating Market Report.

Developed by the U.S. Department of Energy's (DOE's) National Laboratory of the Rockies and Geothermal Rising, the report presents geothermal technology, cost trends, and market activity updates since 2020. A notable difference since the 2021 report is the inclusion of geothermal heat pumps (GHPs) for single building and district heating and cooling applications.

Photo from Fervo Energy

Geothermal Power Generation—Key Findings

Since 2020, geothermal power production in the United States has grown at a steady pace. There are slightly more geothermal plants in operation now, while some older, less cost-effective plants have been retired. Since the 2021 report, 26 new power purchase agreements have been signed as of June 2025. Policies, successful testing of new technologies at both lab research and commercial demonstration scales, and growing interest in geothermal as a reliable energy source all suggest that the industry is on track for growth in the near future.

Installed Capacity Growth in the Western United States

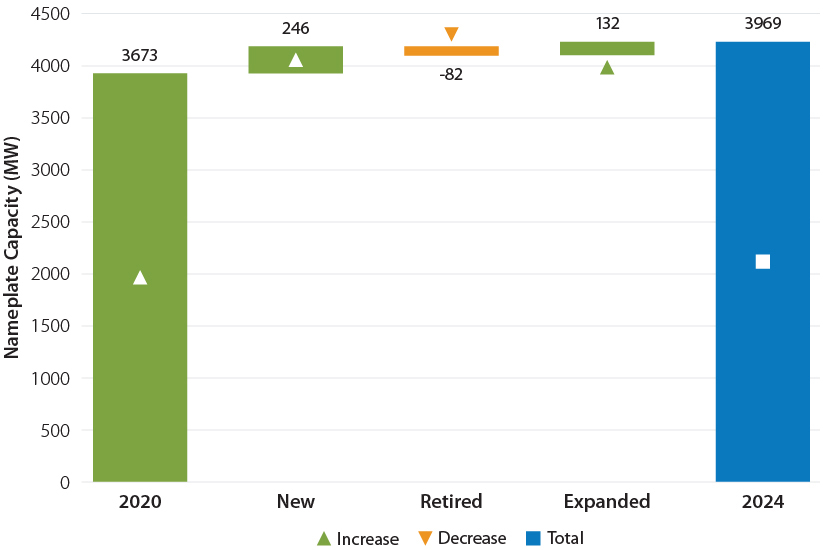

As of 2024, U.S. geothermal power nameplate capacity reached 3.97 gigawatts-electric (GWe), or 3,969 megawatts-electric (MWe)—an 8% increase from 3.67 GWe (3,673 MWe) in 2020.

Growth includes:

246 MWe

New capacity

132 MWe

Expansions/additions

82 MWe

Plant retirements

Summer and winter annualized mean net generation capacities rose from 2.56 GWe and 2.96 GWe in 2019 to 2.69 GWe and 3.12 GWe in 2023. Two operators, Ormat and Calpine remain the dominant operators, accounting for 69% of installed capacity and 61% of all operating U.S. geothermal plants.

Geothermal nameplate capacity growth in the United States since the 2021 report. Note that "new" refers to nine new plants that have come online, "retired" represents six plants that are no longer operational, and "expanded" includes plants that have reported changes in their capacity. Figure by Dominique Barnes, National Laboratory of the Rockies

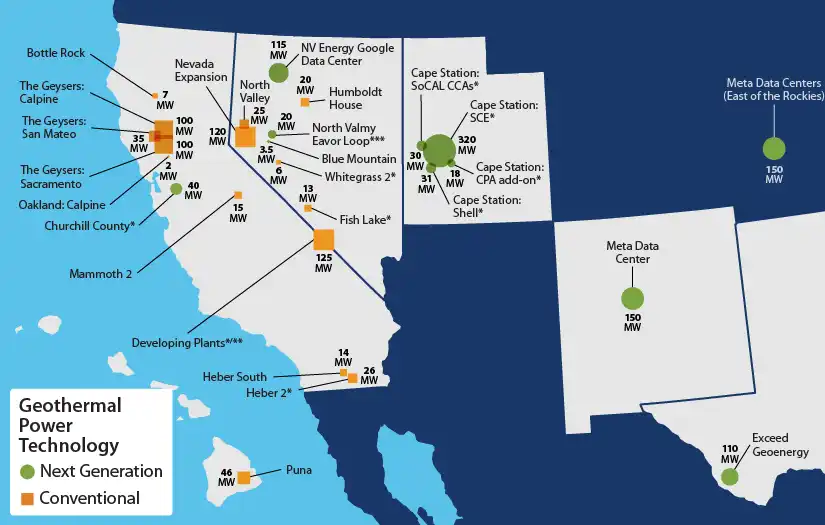

California hosts 53 of the 99 U.S. geothermal power plants, totaling 2.87 GWe or 2,868 MWe (72% of national capacity). Nevada ranks second with 32 power plants and an installed nameplate capacity of 892 MWe. Oregon and Utah each have four plants; Hawai'i and Alaska, two each; and Idaho and New Mexico, one each.

Distribution and installed nameplate capacity of geothermal power plants in the U.S. In the power plant totals for each state, a single plant is described by the installation year as it can consist of one or more generating units installed over years. Some plants like McGinness Hills and Puna, have been expanded in subsequent years after the first unit was installed. These are treated as separate plants. Figure by Dominique Barnes, National Laboratory of the Rockies

U.S. geothermal capacity by plant technology.

Power Purchase Agreements and Project Development

Since 2021, 26 new power purchase agreements (PPAs) totaling over 1.6 GWe (1,642 MWe) have been signed. At least 616 MWe in PPAs were driven by a 2021 procurement order from the California Public Utilities Commission, which incentivized geothermal imports from Nevada and Utah.

California, Nevada, Utah, New Mexico, Texas, Hawai'i, and the region east of the Rocky Mountains, have several geothermal power technologies. In the map above, the circles represent next generation geothermal technology locations and the squares represent conventional geothermal technology locations. Figure by Dominique Barnes, National Laboratory of the Rockies

Next-generation geothermal systems account for 60% of PPAs. The first PPAs for next-generation systems were signed in 2022. Through NV Energy, Google became the first to receive power from an enhanced geothermal system (EGS) project. As of June 2025, utilities have procured (or agreed to procure) through 11 PPAs, 984 MWe of next-generation geothermal power capacity across:

- California (439 MWe)

- Nevada (135 MWe)

- New Mexico (150 MWe)

- Texas (110 MWe)

- Undecided location east of the Rocky Mountains (150 MWe).

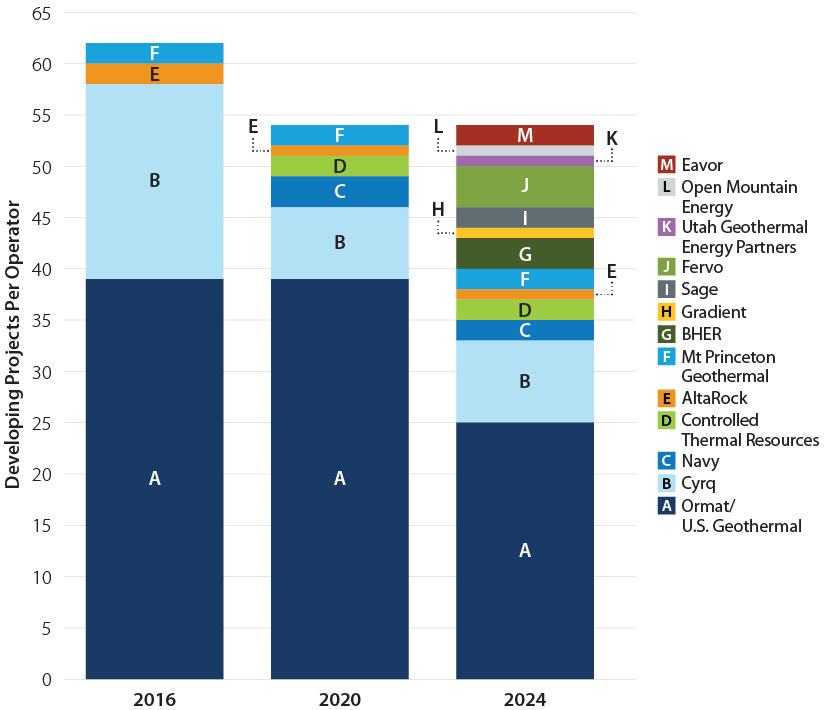

Projects under development increased from 54 in 2020 to 64 in 2024. Overall, Ormat continues to lead in commercial geothermal development, with 37 projects under development. Fervo Energy is leading commercial next-generation geothermal with four projects under development.

U.S. geothermal developing projects by operator as reported in the 2023 industry survey with additions confirmed by NLR analysts, excluding operators that are no longer active. This chart includes data that were not reported in the 2023 industry survey but were confirmed as being in development through investigation by NLR analysts. Figure by Dominique Barnes, National Laboratory of the Rockies

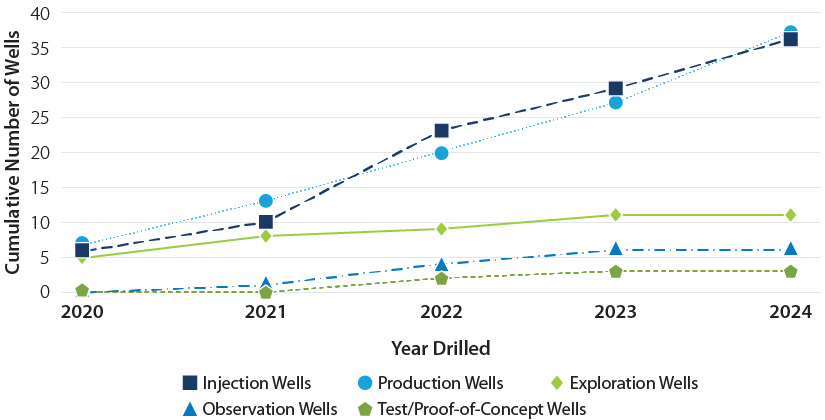

Next-Generation Technology Development

The development of next-generation geothermal technologies, including EGS and closed-loop geothermal, has accelerated in recent years. These technologies are heavily reliant on cost-effective well construction and reservoir creation (EGS only). The Utah FORGE site has been largely successful in showing a replicable process for developing EGS reservoirs. A total of seven wells have been drilled, and improvements in drilling performance were achieved including a reduction in drilling time from 310 hours in 2020 to 110 hours in 2023.

In 2023, Fervo Energy recorded the first commercial-scale EGS reservoir development in the United States adjacent to the Blue Mountain Geothermal Plant in Nevada and is developing a first-of-a-kind large-scale 400-MWe (now upgraded to 500 MWe) commercial EGS power plant at Cape Station in Utah.

Closed-loop geothermal systems also advanced. Eavor Technologies drilled the first two-leg multilateral deep geothermal well in New Mexico in 2022 to 18,000 ft and 250°C rock temperatures.

New U.S. geothermal wells by year and type. Figure by Dominique Barnes, National Laboratory of the Rockies

Improved Drilling Rates

Pilot demonstration and commercial projects—including the Utah FORGE project and Fervo's Project Red and Cape Station drilling campaigns—have resulted in notable geothermal drilling performance, efficiency, and cost improvements. For example, drilling rates at Utah FORGE have improved by more than 500% since 2017. Drilling rates are approaching standard oil and gas performance levels.

Resource Potential on Public Lands

NLR estimates average EGS resource potential is 27 to 57 terawatt-electric (TWe) within 1 to 7 kilometers (km) depth across the United States. Of this, 4.35 TWe is on Bureau of Land Management (BLM) and U.S. Forest Service land, with 47.8 GWe considered economically developable. As of 2024, geothermal projects on public lands total 2,600 MWe of nameplate capacity. In 2022, 51 geothermal power plants on BLM-managed lands generated 11.1 terawatt-hours (TWh) of electricity.

Costs and Financing

Project developments are made possible through decreasing costs. The levelized cost of energy (LCOE) for EGS is declining and is projected to hit levels of 2024 flash hydrothermal LCOE within the next decade. The LCOE for conventional hydrothermal systems remains steady at $63–$74 per megawatt-hour (MWh) for flash-based plants and $90–$110 per MWh for binary plants. These are competitive with current PPA prices.

The levelized cost of electricity for geothermal power technologies from the 2021 to the 2024 Annual Technology Baseline. All costs are in 2022 dollars (the 2024 Annual Technology Baseline base year). Figure by Dominique Barnes, National Laboratory of the Rockies

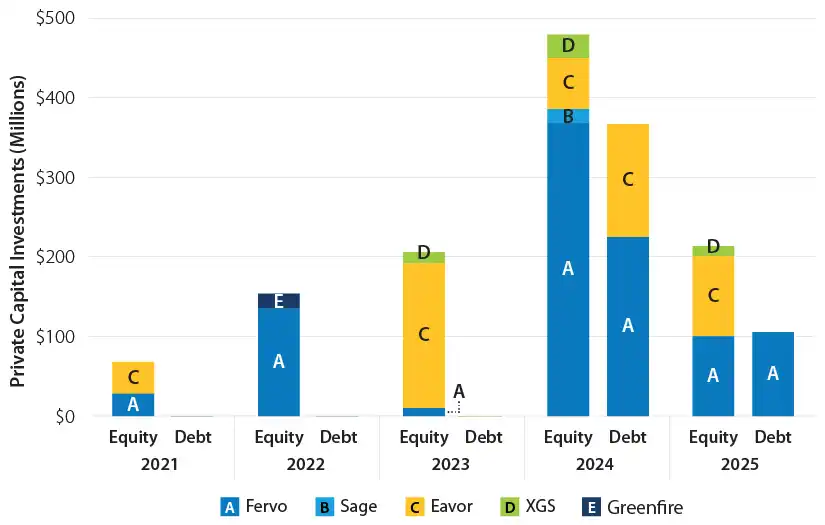

More than $1.5 billion in capital has been invested in next-generation geothermal companies since 2021. Between January 2021 and June 2025, Fervo Energy secured $642 million in equity and $331 million in debt financing, while Eavor Technologies raised $387 million in equity investments and received $142 million in debt financing. Sage Geosystems, XGS Energy, and Greenfire Energy secured $17 million, $56.7 million, and $19 million, respectively within the same period.

Bar chart showing private capital investments in the millions from 2021-2025 comparing equity and debt for Fervo, Sage, Eavor, XGS, and Greenfire. Figure by Dominique Barnes, National Laboratory of the Rockies

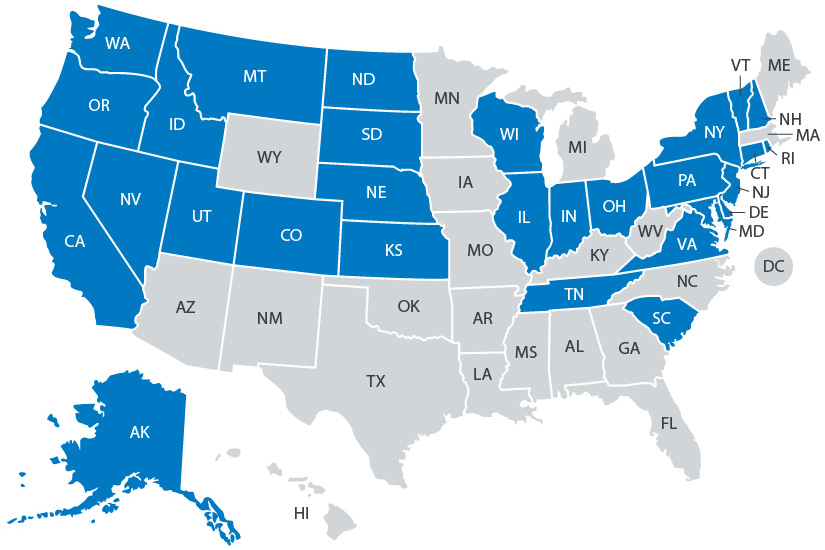

Policies

As of December 2025, 29 states offer incentives for geothermal electricity projects. Seventeen states and Washington D.C. promote geothermal electricity through tax credits. Forty-two states and Washington D.C. include geothermal energy policies such as portfolio standards, efficiency standards, net metering, and/or interconnection standards.

States with Existing Incentive Policies for Geothermal Power

Figure by Dominique Barnes, National Laboratory of the Rockies

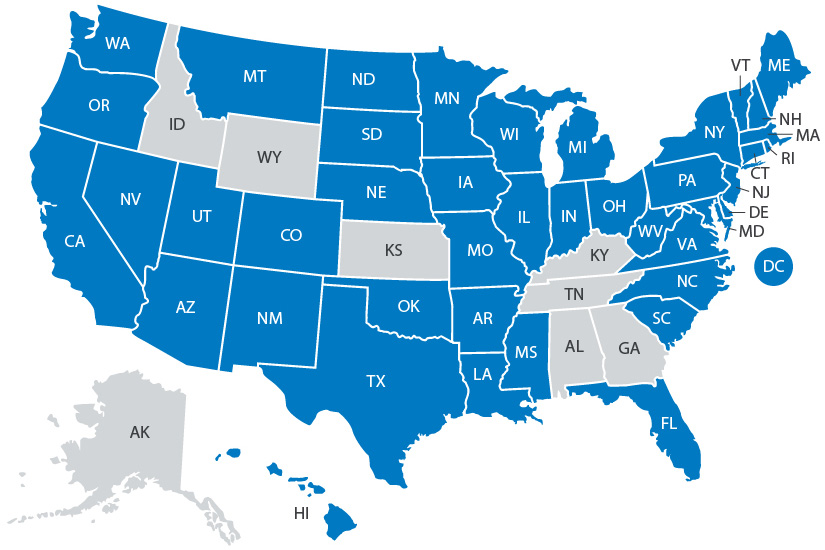

States with Existing Regulatory Policies for Geothermal Power

Figure by Dominique Barnes, National Laboratory of the Rockies

Geothermal Heating and Cooling—Key Findings

Geothermal energy can be used to provide both heating and cooling for residential and commercial buildings across multiple geographic and climatic regions. The market for geothermal heating and cooling in the United States is well established, with numerous installations at single buildings and at the district scale.

The geothermal system at the College of Southern Idaho in Twin Falls. Photo from College of Southern Idaho

Geothermal Heat Pumps

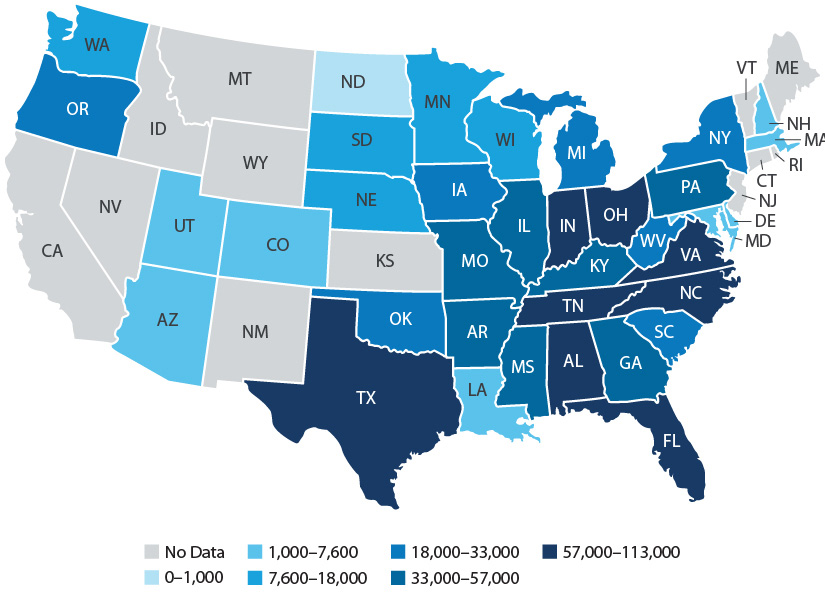

Geothermal heat pump (GHP) installations are increasing. Based on data conclusions from the Residential Energy Consumption Survey and the Commercial Building Energy Consumption Survey, an estimated 1.27 million homes and 27,300 commercial buildings have GHPs, with the highest residential adoption in Florida, Tennessee, and North Carolina.

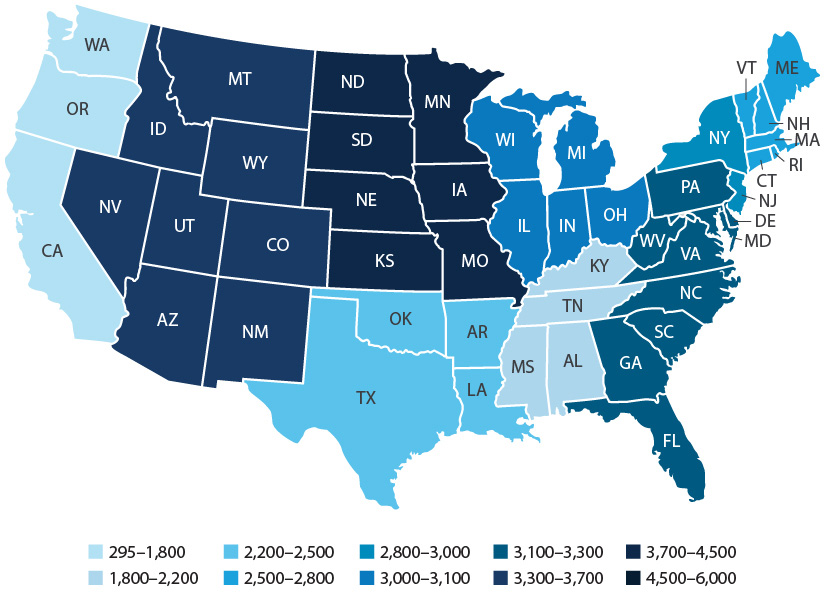

The Number of Residential Housing Units with GHPs

Estimated number of residential buildings with GHPs using EIA 2020 RECS microdata version 7. EIA 2020 RECS includes the number of housing units with GHPs at state level. No data were available in 2020 RECS for GHP usages in Alaska, California, Connecticut, District of Columbia, Idaho, Kansas, Maine, Montana, Nevada, New Jersey, New Mexico, Rhode Island, Vermont, and Wyoming. Figure by Dominique Barnes, National Laboratory of the Rockies

The Number of Commercial Buildings with GHPs

Estimated number of commercial buildings with GHP using the Energy Information Administration's 2018 Commercial Buildings Energy Consumption Survey data. Note that this data is recorded at census division level. The survey collected data for 6,436 buildings, representing 5.9 million (i.e., 0.11% of) commercial buildings in the United States. Figure by Dominique Barnes, National Laboratory of the Rockies

Grid Infrastructure Benefits

GHPs can offer up to $1 trillion in value by avoiding grid infrastructure expansion. Oak Ridge National Laboratory estimates that GHP deployment in 68% of single-family homes by 2050 could cut electric system costs by $306 billion and wholesale electricity costs by $606 billion. Widespread GHP deployment can reduce required additional annual generation by 585–937 TWh and power and storage capacity by 173–410 GW. Mass GHP deployment is also expected to alleviate the need for transmission expansion by 3.3–65.3 TW-mile.

Available Incentive Policies

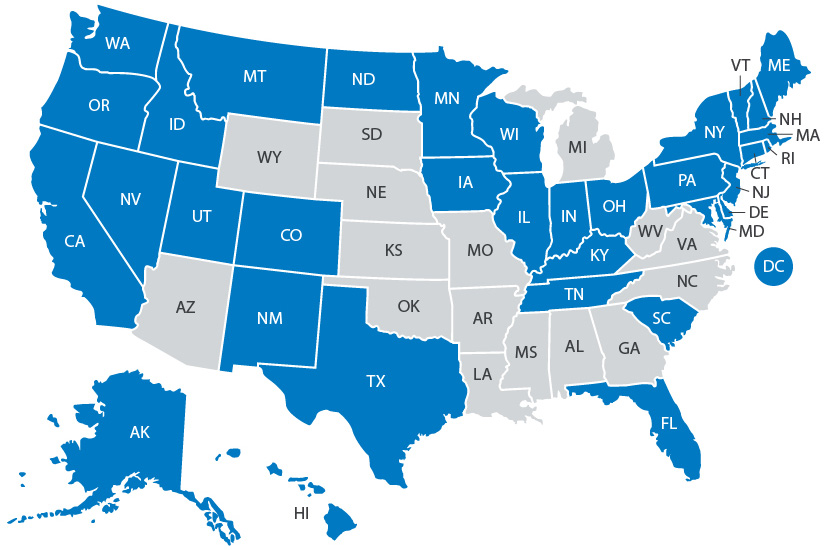

In the United States, 34 states and Washington D.C. have incentive policies for GHPs.

State Level Existing Incentive Policies for Geothermal Heat Pumps

Over half of the United States, as highlighted in the map above, have GHP incentive policies. Figure by Dominique Barnes, National Laboratory of the Rockies

In the United States, 23 states and Washington D.C. have regulatory policies for GHPs, including:

- Portfolio standards

- Efficiency standards

- Net metering (or lack thereof)

- Interconnection standards.

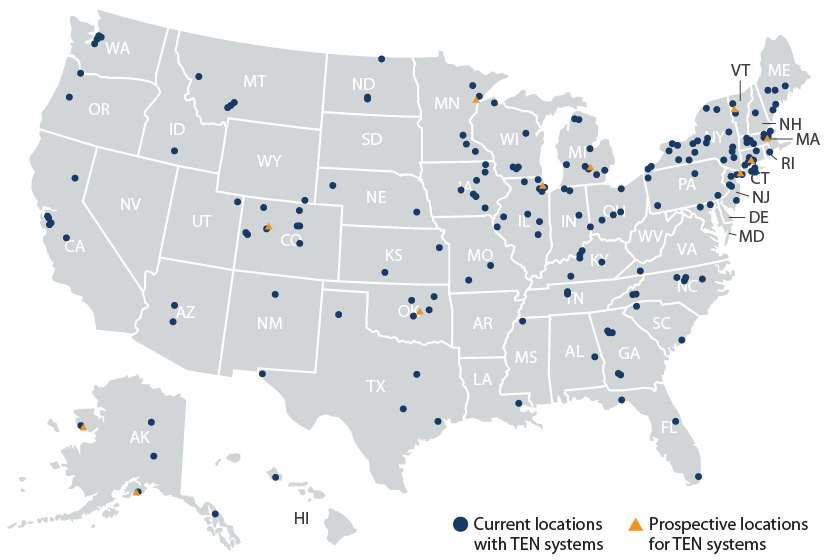

Thermal Energy Networks

Thermal Energy Networks (TENs) with decentralized GHPs connected to a shared distribution loop are gaining interest across the country. Massachusetts, New York, Colorado, Vermont, Minnesota, Washington, Maryland, and California have enacted regulations and announced programs that specifically address the need for geothermal TENs within energy utility service territories. In 2024, the natural gas utility Eversource Energy commissioned a first-of-its-kind U.S. utility-owned geothermal TEN pilot in Framingham, Massachusetts. The project consists of an ambient temperature loop that connects decentralized GHPs in 36 buildings to 3 borehole fields.

Existing geothermal district heating and cooling GHP installations on campuses across the United States. It is important to highlight that this map extends the definition of TENs to accommodate single large buildings and GHP installations in more than two buildings.

Geothermal Direct Use

Power generation for whole-building electricity demand isn't always the main purpose of geothermal resources. As of October 2024, the United States had close to 500 geothermal direct use (GDU) installations (by end-use application):

- 281 for resorts/pools

- 77 for space heating

- 47 for aquaculture

- 37 for greenhouses

- 25 for district heating

- 15 for other applications, including dehydration, snow melting, irrigation, and gardening.

California has the highest amount (89) of GDU installations.

Geothermal direct-use distribution within the United States (as of October 2024). Data include resorts/pools (281), aquaculture (47), district heating (25), space heating (77), and greenhouses (37). "Multiple" systems combine two of the prelisted uses. "Other" uses include dehydration, snow melting, irrigation, and gardening.

Incentive and Regulatory Policies for Geothermal Direct Use

In the United States, 17 states and Washington D.C. have incentive policies for GDU, including grants, rebates, tax and other financial incentives. In addition, 8 states, the U.S. Virgin Islands, and Puerto Rico have existing regulatory policies related to GDU including:

- Portfolio standards

- Efficiency standards

- Net metering (or lack thereof)

- Interconnection standards.

Emerging Opportunities—Key Findings

Geothermal energy can help meet growing energy demands by providing reliable and efficient solutions. Innovations like superhot geothermal, which taps into deeper and hotter resources than conventional systems, have the potential to significantly increase well output at competitive costs. Hybrid energy systems—combining geothermal with other energy sources—can further improve overall efficiency and reliability.

Energy Security and Independence

Between September 2023 and April 2024, the U.S. Department of Defense awarded six projects related to energy security and independence to explore the potential of conventional and next-generation geothermal technologies in a total of seven installations at: Joint Base San Antonio in Texas, Fort Wainwright in Alaska, Mountain Home Air Force Base in Idaho, Fort Irwin in California, Naval Air Station Fallon in Nevada, Naval Air Facility El Centro in California, and Fort Bliss in Texas.

Geothermal for heating and cooling is not affected by supply chain disruptions and energy price fluctuations like conventional heating fuels. Twenty-four GHP projects were awarded in federal buildings between 2001 and 2014, leading to energy and maintenance cost savings.

Data Centers

Data center load growth has tripled over the past decade and is projected to almost triple by 2028. Geothermal energy has the potential to play a role in meeting the rapidly growing power demands of artificial intelligence (AI)-driven data centers by providing reliable electricity as well as critical opportunities to reduce peak data center cooling demands through underground thermal energy storage. Major technology companies have already turned to geothermal energy to power their operations. In 2024, Meta signed a PPA with Sage Geosystems for up to 150 MWe of geothermal power and Google expanded its partnership with Fervo Energy and NV Energy by securing 115 MWe to supply its Nevada data centers.

Superhot Geothermal

Superhot geothermal can produce 5–10 times more energy per well than conventional systems. NLR estimates that harnessing heat from superhot resources shallower than 10 km could supply up to 50% of current global electricity demand. DOE's Geothermal Technologies Office (GTO) is funding research to de-risk superhot exploration and demonstrate superhot EGS at Oregon's Newberry Volcano.

Mineral Extraction from Geothermal Brines

Another emerging opportunity for geothermal is lithium mineral extraction from geothermal brines. Findings from Lawrence Berkeley National Laboratory indicate the Salton Sea lithium resource is estimated to be close to 3,400 kilotons, which has the potential to create a domestic lithium industry in the United States. GTO and DOE's Advanced Materials and Manufacturing Technologies Office are supporting 10 projects to advance extraction technologies.

Additionally, GTO, the Advanced Materials and Manufacturing Technologies Office, and DOE's Office of Fossil Energy have awarded seven research and development projects across four national laboratories for critical minerals characterization within the Salton Sea, the Smackover formation in Louisiana, and Utah's Paradox Basin.

Flexible Generation and Grid Stability

Geothermal also can provide stable and flexible generation. Hybrid plants combining geothermal with other energy sources are in use at Cyrq Energy's Patua project, Ormat's Tungsten Mountain project, and Ormat's (formerly Enel's) Stillwater project.

DOE has separately selected two demonstration projects in this space. The first will develop a 100-kilowatt-electric (kWe) power plant with more than 12 hours of geological thermal energy storage (GeoTES) in depleted oil reservoirs in Kern County, California. While the other, to be funded by GTO, will feature a GeoTES demonstration project at Kern Front Oil Field in the same county for industrial heating end use.

Download the Full 2025 U.S. Geothermal Market Report

For information about NLR's geothermal capabilities, see the Geothermal website.

For citations, reference the full report.

Share

Last Updated Jan. 12, 2026