Policy and Regulatory Readiness for Utility-Scale Energy Storage: India

NLR's energy storage readiness assessment for policymakers and regulators, summarized on this page, identifies areas of focus for developing a suite of policies, programs, and regulations to enable storage deployment in India.

India's electric power system is evolving. The combined changes in the mix of generation resources and patterns of electricity demand present new challenges and opportunities in operating and maintaining a reliable power system. Energy storage has the potential to meet these challenges. The potential for storage to meet these needs depends on many factors, including physical characteristics of the power system and the policy and regulatory environments in which these investments would operate.

Read the full NLR technical report: Policy and Regulatory Environment for Utility-Scale Energy Storage: India.

Key Findings

- The technical system characteristics of the Indian power system are favorable for energy storage to reduce operating cost and improve system reliability.

- Storage can provide energy arbitrage, ancillary services, and potentially defer transmission investments, but existing policy and regulatory barriers may limit these opportunities.

- If Indian policymakers want to broaden the role of energy storage in the power system, an important first step is to include energy storage in national energy policies and programs.

- Existing regulations that do not allow storage to provide services or earn revenue for those services present a barrier to maximizing the value of storage investments.

| Status | Grade | Description |

|---|---|---|

| Supports deployment of energy storage systems | Monitor | Existing system conditions (technical or nontechnical) support energy storage deployment. Monitor and review these conditions to continually improve. |

| Moderate to no impact on energy storage systems | Review | Existing system conditions have limited impact on energy storage deployment. Review to better align with storage investments. |

| Barrier to energy storage systems | Revise | Existing system conditions may prevent energy storage investments. Revisions may be needed to remove barriersa |

System Characteristics

The technical characteristics of the Indian power system are favorable for energy storage investments and operation. There are opportunities for storage to provide energy arbitrage, ancillary services, and potentially defer transmission investments.

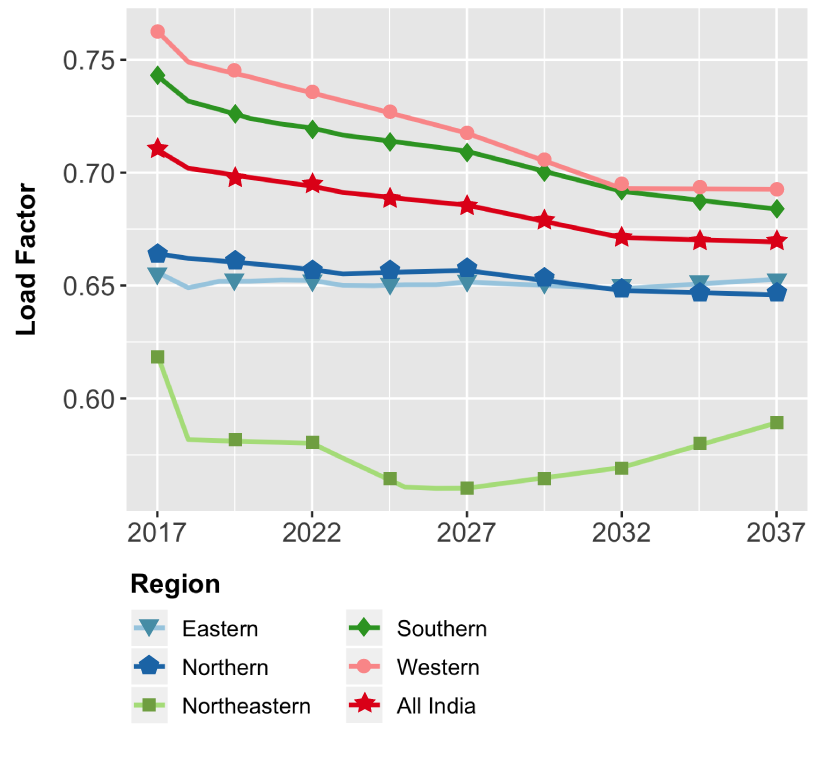

Load factor is an expression of the utilization of the system. Low load factors indicate volatility in demand and sometimes require that capital-intensive generation or transmission resources be built to serve load only for a short time. Load factors in India have been declining and are projected to continue to do so, indicating a growing opportunity for energy storage to provide energy arbitrage or resource adequacy services. Over the 2016 to 2020 period, India's load factor declined by 2%. CEA forecasts that the total load factor will decline by an additional 4% by 2037 before stabilizing. Regions predicted to see the steepest declines include the Western and Southern regions with declines of 7% and 6%, respectively, from 2020 to 2037.

Forecast changes in load factor 2017—2037 by region and for all of India

Source: CEA 2018

As the daily load profile in these regions becomes more variable with larger swings between peak and off-peak electricity demand, energy storage technologies can help stabilize electricity demand by providing load following or peak demand management services. These opportunities already exist in some locations, such as Delhi and Kerala, that already experience large daily swings in electricity demand.

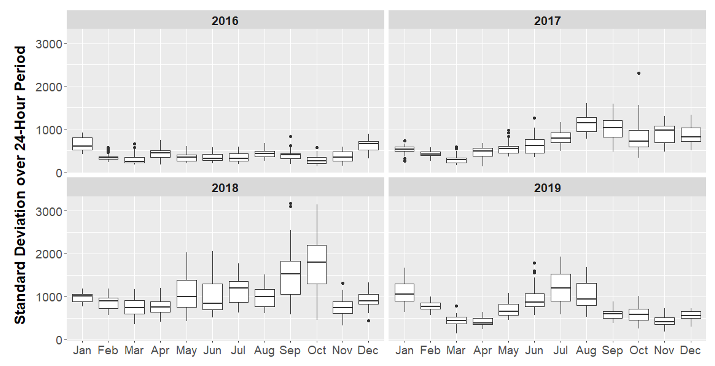

Another approach to understanding potential opportunities for energy arbitrage is by analyzing price fluctuations in the wholesale energy market. While 90% of demand in India is met through long-term contracts, wholesale market exchanges are growing, with the IEX being the predominant option. We analyzed IEX price data from 2016 to 2019 and found an increase in the size and frequency of daily price fluctuations with a pronounced seasonal pattern. Higher fluctuations were observed from June to October, when both electricity demand and renewable generation is highest. The seasonal nature of price variations suggests that a modular and easily deployable energy storage technology may be preferable to investments in transmission or conventional generation because the energy arbitrage opportunity may only exist for a few months of the year.

Daily standard deviation of IEX prices (over 24-hour period) by month and year

Source: IEX

Understanding the size, frequency, and duration of daily IEX price spikes can also inform which energy storage technologies may be best suited to provide peak load management or energy arbitrage services. We find the number and duration of daily price spikes vary during different times of year. Summer months tend to have flatter price curves with only one peak at the end of the day that lasts, on average, 4 hours. Winter months, by contrast, experience a morning and evening price spike lasting, on average, 6 hours. Analysis of India's electricity demand forecast and market prices reveals a growing opportunity for energy storage to provide energy arbitrage and resource adequacy services. To maximize this opportunity, the appropriate storage technology would require daily or twice-daily cycling with up to 4 hours of discharge capability.

India is in the process of expanding its ancillary services sector, presenting a growing opportunity for energy storage. The current ancillary services include inertial, primary, and slow tertiary response. There is no ancillary services market in India; system needs are met through regulatory requirements in the grid code or through unscheduled surplus capacity.

Inertial and primary response services are automatic adjustments to maintain grid stability within seconds or minutes of a deviation. While generators are required to provide these services, actual primary response has been lower than desired at times due to technical difficulties for units to respond in time and some generators not retaining adequate capacity on reserve.

Slow tertiary response, also referred to as reserves regulation ancillary services, is provided by unscheduled capacity from interstate generating stations. Because these services are only obtained through uncommitted surplus capacity, there is no guarantee the generation capacity will be available when needed. POSOCO reports inadequate surplus to meet requirements for reserves regulation ancillary services during some peak demand hours. Over the 2018–2020 operating years, India's grid frequency fell below its lower limit of 49.9 Hz in 9% of operating periods. Further, the primary sources of ancillary support are thermal generators, which are limited in how quickly they can ramp their output levels up or down.

CERC has outlined the need to expand the range of ancillary services and types of technologies eligible to provide these services. For example, secondary reserves through automatic generation control (AGC) connected to generating units and controlled centrally are currently being piloted. And a separate pilot was initiated in 2018 to capitalize on the inherent flexibility of hydropower technologies.

Energy storage—including hydropower and non-hydropower technologies—could further expand the quantum of fast-response technologies available for ancillary services. Technologies such as flywheels and batteries can respond to control signals at subsecond time levels. Further, improving the accuracy and speed of response can reduce the amount of ancillary services that must be procured.

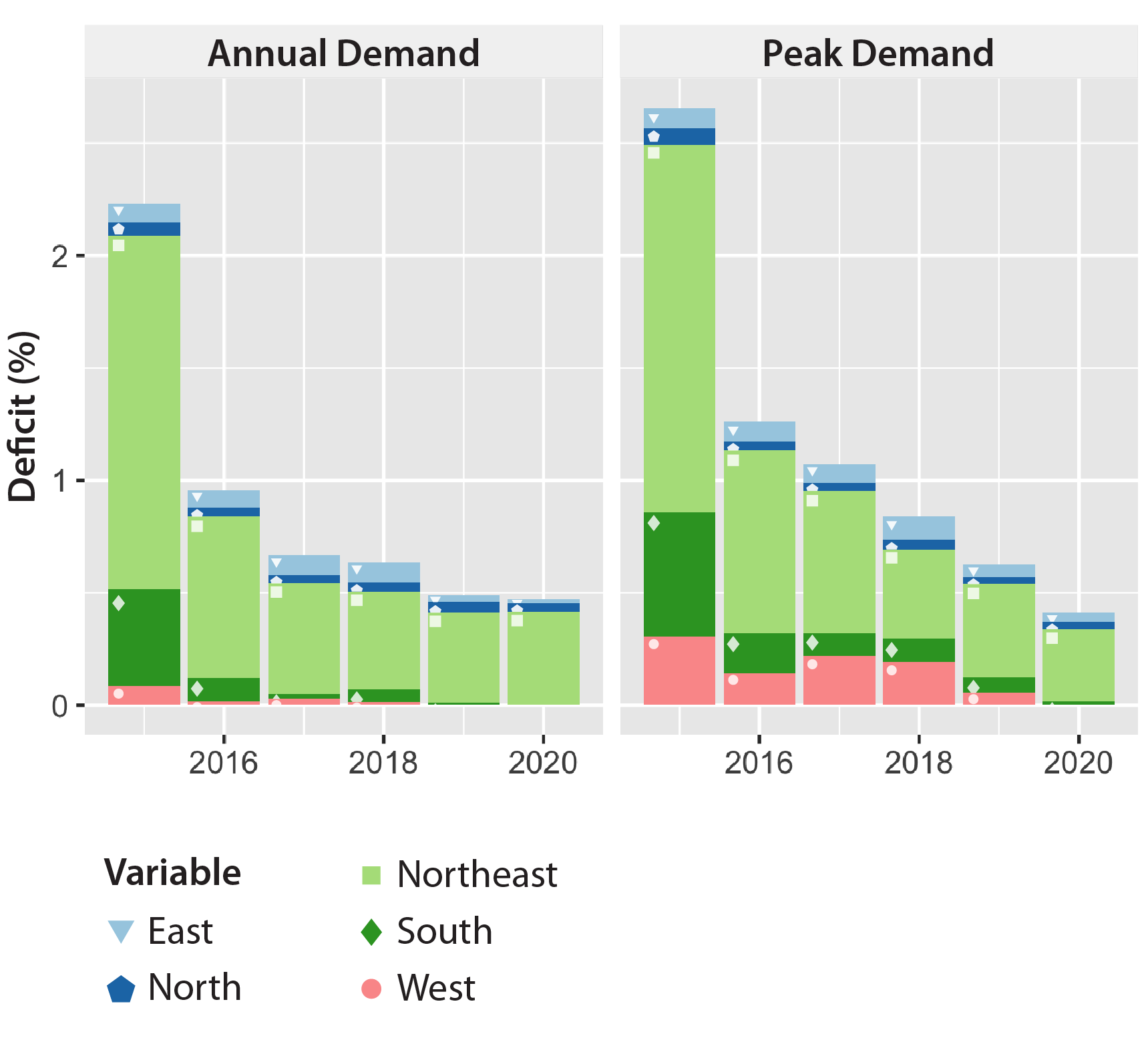

Investments in generation and transmission infrastructure have reduced India's supply deficit in recent years. Total and peak demand shortfalls have fallen to less than 0.5% nationally. At the regional levels, there are persistent differences in system reliability with the Northern region experiencing the highest levels of unmet demand; however, these deficits amounted to less than 2% of Northern region annual and peak demand not met in 2019.

Annual and peak demand deficits by region, 2015–2020

Source: CEA Monthly Reports Archive

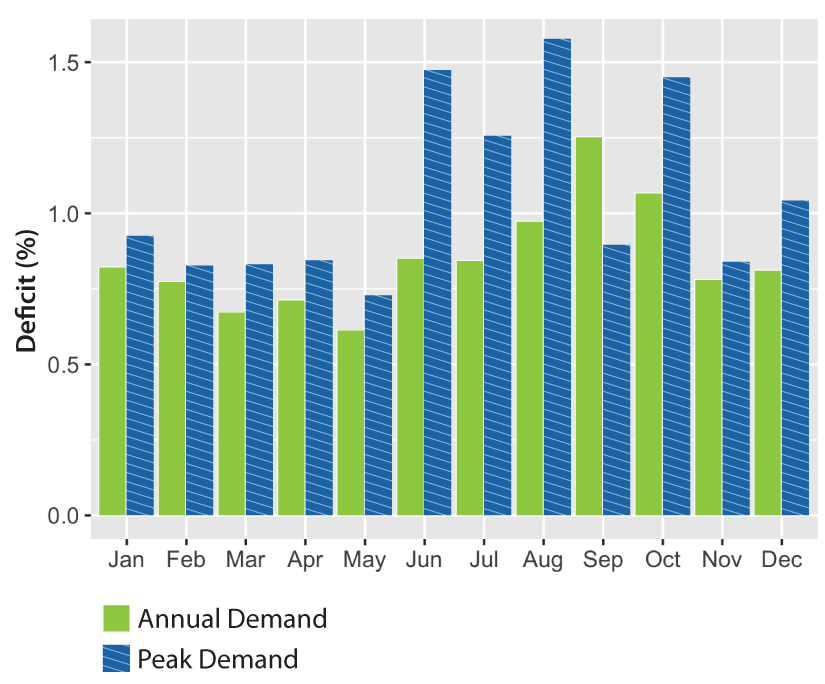

Generation deficits follow a seasonal pattern, with higher instances of unmet demand during the June-October months.

Figure 5. Percentage of annual peak demand not met by month, averaged over 2015–2020

Source: CEA Monthly Reports Archive

The COVID-19 pandemic has affected the outlook for energy demand and supply in India. Recently published CEA projections forecast an energy surplus of 3% and a peak surplus of 9% for the year 2020–2021. According to the forecast, only the Eastern region is forecast to experience an energy deficit; however, as economic activity increases in the coming months and years, growing demand may once again strain existing supplies.

Currently, many distribution utilities purchase power from short-term energy markets to meet peak demand. In June 2019, the average market clearing price during peak demand periods reached as high as Rs 8.89 per kWh. The price for the top 10% of peak demand hours was above Rs 4.6 per kWh for the same month. Long-term power purchase agreements with thermal generators are generally a less expensive option to meet peak demand. The average tariff for gas- and coal-based power stations is Rs 3.85 per kWh and Rs 3.55 per kWh, respectively. However, investing in new thermal power stations to meet demand during only a few hours or months of the year may not be economically strategic over the long term. By the end of 2019, India had Rs 3-4.5 trillion ($40-60 billion) in stranded generation assets due to low levels of utilization, fuel shortages, and lack of profitability.

Energy storage presents an increasingly cost-competitive alternative to meet existing and future peak demand needs. BNEF estimates a 4-hour lithium-ion battery could already displace poorly utilized open-cycle gas turbines in India and will be competitive with combined-cycle gas turbines with low utilization by 2025. Energy storage could also bolster the ability of renewable generators to displace conventional technologies as peaking resources through hybrid projects. Researchers at Lawrence Berkeley National Laboratory estimate the cost of a solar plant plus a battery storing 25% of the solar energy is Rs 3.94 per kWh in 2020 and could decline to Rs 2.83 per kWh by 2030. BNEF estimates a new PV or wind power project with 1-hour battery storage is already competitive with gas power plants in India. Falling battery prices could make longer-duration hybrid projects competitive by 2030. In fact, some of these prices are already being achieved. The first centralized auction for renewable energy paired with energy storage to provide "round-the-clock" renewable power in May 2020 achieved a tariff of 2.9 rupees ($0.039) per kWh, 25% lower than the average tariff for coal-based power stations.

Energy storage technologies with one- to four-hour discharge could contribute to peak demand management and avoid the need for investments in new generation capacity with low anticipated utilization.

India experiences limited instances of congestion on the ISTS but instances of localized congestion may present a growing concern. Over the 2017–2020 period, POSOCO reports monthly violations of total transfer capacity (TTC) in 3% of hours. TTC violations are highest June–October and are more pronounced over import corridors into the Northern and Northeastern regions. It is also notable that, in most cases, instances of TTC violations are not increasing over time. In cases where transmission congestion is intermittent and not increasing, energy storage may be a viable alternative to building new transmission infrastructure.

TTC violations by month, March 2017–December 2019

ER: Eastern Region; NER: Northeastern Region; NR: Northern Region; SR: Southern Region;

WR: Western Region;

Source: POSOCO Monthly VDI/TTC/ATC

Localized transmission congestion due to injections of RE are a growing concern. For example, POSOCO reports output from the Bhadla Solar Park in Rajasthan has resulted in overloaded lines for the last five quarters. Similarly, Gujarat has experienced overloading transmission lines during high wind generation periods due, in part, to the remote location of the wind farms. Storage co-located with renewables can improve transmission operations by absorbing excess generation and providing frequency and voltage support.

Energy storage can potentially delay, reduce, or avoid the costs of transmission investments by providing extra capacity to meet peak demand needs. NLR's production cost modeling of India's planned 2030 power system reveals that 71% of the ISTS transmission corridors (out of 663 modeled) may experience an average annual utilization rate of 30% or less. Further, 9% of lines are anticipated to have zero power flow for over a quarter of the year. Low levels of utilization tend to occur during the night and middle of the day when net electricity demand is low. These results suggest that, for certain underutilized transmission corridors, energy storage may be an economic alternative to transmission upgrades.

India's growing penetration of renewable energy will increase the flexibility needs of the rest of the generation fleet to balance supply and demand. POSOCO reports that the daily variation in output from the thermal fleet has increased from 8%–10% in 2009 to 15%–18% in 2019. On average, the daily change in net load that must be met by the thermal fleet is 15–17 GW. However, this requirement is increasing rapidly at a rate of 5–7 GW per year, reaching as high as 56 GW during the winter of 2019–2020.

India relies primarily on thermal generators to meet load following needs, but these units are ramp-limited resources and cannot respond quickly to control signals to change their output. CEA requires a 3% per minute ramp rate for thermal generators operating above the 50% Maximum Continuous Rating. However, analysis by POSOCO found that only 35% of thermal generators in India are providing at least 1% per minute ramping capability; the majority of coal-fired central generating station are declaring a ramping capability of 0.5%–0.7% per minute. Similarly for minimum loading, CERC requires a minimum generation level of 55% for interstate generators but a recent report by POSOCO reveals only 6% of central generating stations are reaching a minimum generation level below 60%. On an all-India basis, about 60% of units are flexing their output by 20%–30% of installed capacity.

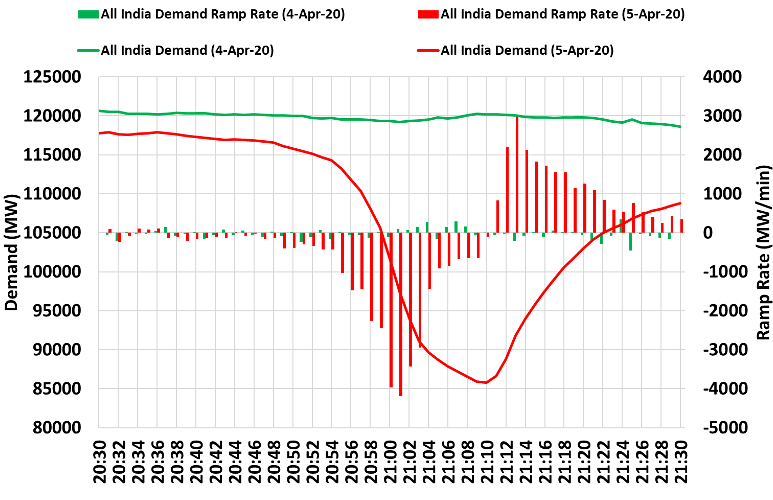

Fast-ramping hydropower and gas units are also contributing to meet ramping needs. During the "Lights Off" event on April 5, 2020, system operators managed unprecedented ramp rates on the order of 3 to 4 GW per minute during the 9 p.m. 9-minute event. In preparation for the event, system operators adjusted the droop settings of some hydro generators to 1%–2% from the normal range of 4%–5% to allow faster response to frequency changes.

Demand and ramp rates trend during the "Lights Off" event

Source: POSOCO 2020e

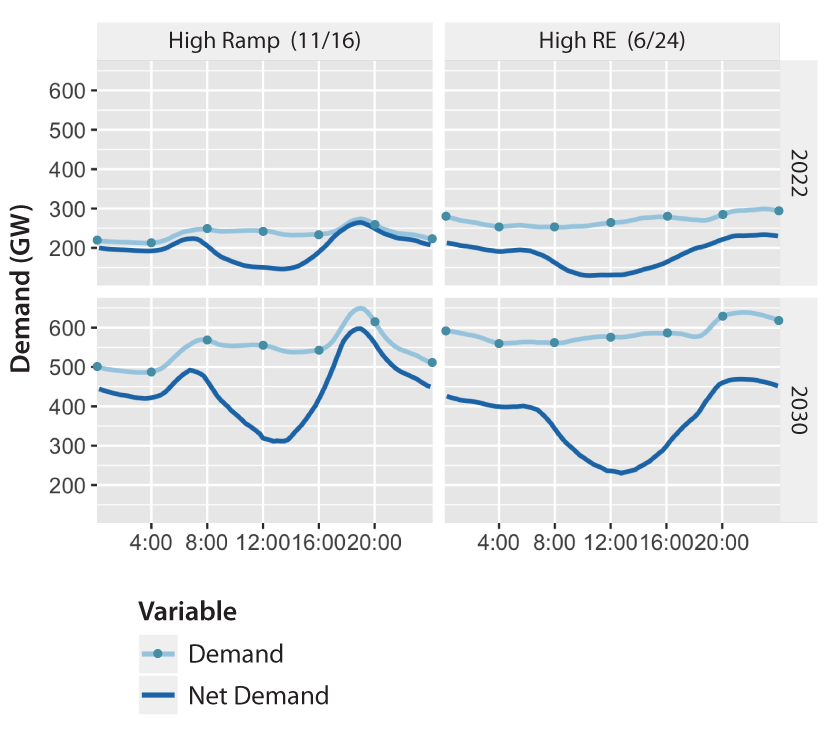

The increase in variable renewable generation, particularly solar, is anticipated to increase the net ramping requirements of the remaining generation sources to turn down in the early morning and ramp up in the evening as solar generation declines and evening peak demand increases. The following figure shows the anticipated load and net load curves on the days with the highest ramping requirements and highest renewable generation in 2022 and 2030. On the day with the highest ramps, the total ramping requirement from the lowest point on the net load curve to the highest is expected to increase from 118 GW in 2022 to 286 GW in 2030, a quantum that exceeds India's entire 2020 thermal capacity. The day with the highest renewable generation is expected to see more than a doubling of renewable generation over this period resulting in larger turn-down of the generation fleet during the day and larger ramp up during the evenings.

Figure 8. Changes in the load and net load curves for the day with the highest ramping requirements (left) and highest renewable generation (right) for 2022 and 2030, respectively.

Source: Palchak et al. 2019

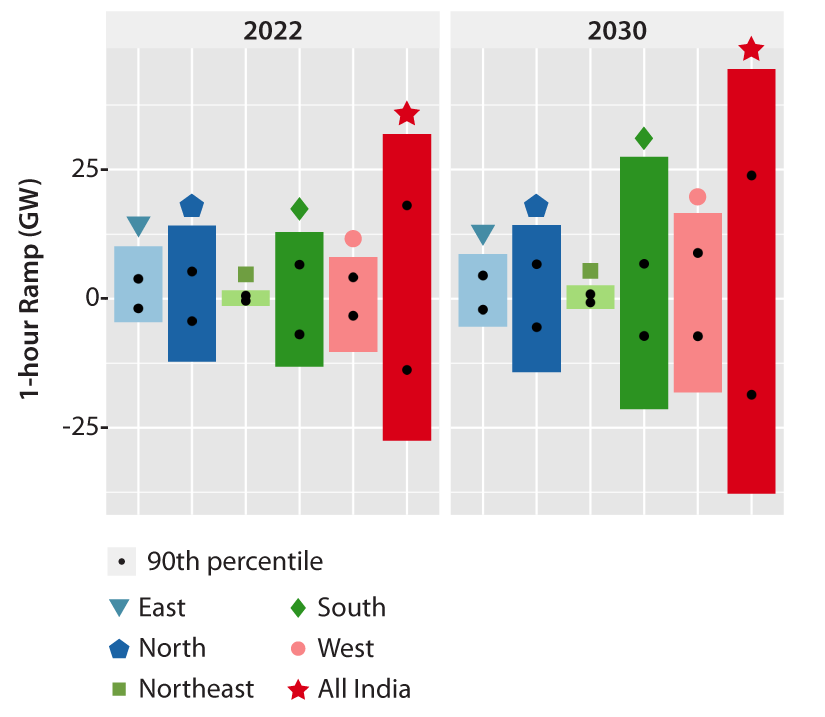

The hourly ramping requirements are also anticipated to increase significantly. The following figure shows the maximum and 90th percentile 1-hour net load requirements for ramping up and down for the years 2022 and 2030 based on NLR's operational modeling.

Anticipated 1-hour ramping requirements by region and all India, 2022 and 2030, respectively

Source: Palchak et al. 2019

Nationally, the maximum 1-hour ramp up could reach 32 GW by 2022 and 44 GW by 2030. The Southern and Western regions are expected to see the largest increases in net-load ramping as investments in new renewable energy capacity are expected to be concentrated in these areas.

Under higher penetrations of renewables, India's power system will need more fast-responding resources for system flexibility. Recent estimates suggest the additional costs of refurbishing India's thermal units to operate more flexibly could reach 5%–10% of the total project cost. The fast response of the hydropower fleet during the Lights Off event, while successful, does not present a long-term solution, as this requires advanced knowledge that the event would occur and running the plants outside of their normal operating range. Energy storage, particularly battery storage that is not subject to the droop setting limits faced by hydropower plants could be a cost-effective solution to meet increasing needs for system flexibility.

Data on renewable energy curtailment in India is limited but available data from select states suggest that curtailment is limited to specific locations and time periods. We analyzed curtailment data from Rajasthan and Andhra Pradesh, two states with high penetrations of renewable energy. From September 2019 to May 2020, 61.9 GWh of wind was curtailed in Rajasthan, equivalent to 1.6% of total wind generation in the state. In Andhra Pradesh, 0.3% (10 GWh) of wind and 4% (185 GWh) of solar was curtailed from August 2019 to May 2020. In both cases, curtailment is infrequent. The number of dispatch periods with curtailment in Rajasthan and Andhra Pradesh is 4% and 6.5%, respectively. The low levels of curtailment indicate that reducing curtailment alone may not drive investments in energy storage; however, increased reporting of curtailment at the national and state level is required to better understand potential opportunities.

One reason curtailment rates are low and infrequent is India's must-run policy, which requires system operators to first redispatch other generators to avoid backing down renewables. In the first half of 2020, thermal generation from state and central generators in Rajasthan was backed down in 89% and 100% of dispatch periods, respectively, totaling 5690 GWh. Increased unit cycling and operating at lower generation levels can increase operating and maintenance costs for thermal generation units as well as decrease the plant's operating life and increase per unit emissions. Therefore, by smoothing the output from renewable generators, energy storage can help to minimize curtailment of renewable generation and improve the operating efficiency of the rest of the generation fleet.

Policy

India's energy policy framework largely excludes energy storage from key programs and initiatives. The lack of policy guidelines and supporting programs to direct the scope and scale of energy storage deployment present a barrier for investments.

Energy storage has received limited attention in India's existing energy policies. The two primary policy documents for the power sector are the 2003 Electricity Act, which covers major issues involving generation, distribution, transmission, grid operation and trading in power, and the 2006 Integrated Energy Policy, which provides a roadmap to develop the broader energy sector and increase the uptake of renewable energy sources. Under the 2003 Electricity Act, the Ministry of Power, in consultation with CEA and State Governments, is required to prepare a National Electricity Policy and Tariff Policy for the development of the power sector. These policies are revised from time to time in response to changing system needs. Energy storage is not explicitly mentioned in the 2003 Electricity Act, the National Electricity Policy 2005, or the Tariff Policy 2016. Organizations such as the India Energy Storage Alliance (IESA) have called for future amendments to include a "clear policy framework regarding energy storage". Recent amendments proposed earlier this year to the National Electricity Policy do not mention storage but include an amendment targeting renewable energy, which may also include storage-friendly components. Proposed amendments to the Tariff Policy include measures to promote PSH only through regulated tariffs.

In the 2006 Integrated Energy Policy and 2017 proposed revision, storage is mentioned several times as an opportunity to supplement the rapid growth in variable renewables and smooth load curves. NITI Aayog surmises that renewables paired with storage, once cost-competitive, will lead to the widespread phase-out of coal across India. To this end, NITI Aayog proposes that all renewable energy installations in the future could be required to be co-located with some form of balancing capacity, either gas-burning power plants or energy storage, to maintain a steady and reliable electricity supply. India's recent round-the-clock power auction, discussed in subsequent sections, seems to be fulfilling this proposal.

Power Minister Singh has proposed introducing a renewable purchase obligation for round-the-clock power as a mechanism to promote energy storage. Under the proposed scheme, increased demand for energy storage would drive investments in storage manufacturing facilities, driving down storage costs, and accelerating the transition to renewable energy. The IESA has also proposed specific policy changes, including allowing storage to provide ancillary services and frequency regulation and adding a storage purchase obligation similar to the existing Renewable Purchase Obligation and proposed Hydropower Purchase Obligation.

Energy storage is also receiving more attention in national planning activities. The CEA, responsible for producing India's long-term plan for the power sector, has historically only considered PSH as the sole energy storage technology in its National Electricity Plan. In the latest Report on Optimal Generation Capacity Mix for 2029–2030, the candidate technologies included 4-hour battery storage, along with PSH. Base scenario results show 27 GW (108 GWh) of battery storage along with 10 GW of PSH would be needed by 2029–2030. CEA's analysis considers a variety of applications for energy storage, including providing ancillary services, load smoothing from renewables, and spinning reserves. This demonstrates an expansion on the singular application to the integration of renewables mentioned by NITI Aayog.

Including clear policy guidelines in the upcoming amendments to the National Electricity Policy, Tariff Policy, and in the final version of NITI Aayog's 2017 Draft National Energy Policy on energy storage can provide a market signal to spur development and direct regulatory authorities to begin implementing targeted regulations. These should address the many services that storage can provide as well as the full range of technologies available.

The Government of India has a number of programs and targets aimed at catalyzing investments and transformation in the energy sector, but none of these include a specific target for energy storage deployment. In some cases, such as India's 450-GW renewable energy targets or auctions for round-the-clock power, energy storage is expected to play a key role in achieving these targets, but there is no accompanying policy or program to stimulate the necessary level of storage investments. The National Mission on Transformative Mobility and Battery Storage aims to coordinate research activities on advanced batteries and establish integrated battery- and cell-manufacturing giga-factories. While the outcomes of this program will likely impact investments in battery storage for grid applications, this primary objective is focused on the needs of the transportation sector rather than the power sector.

There is a growing body of analysis that could be used to inform future targets for utility-scale energy storage. The CEA has identified 96 GW of PSH capacity across 63 sites that could be developed in India. In its Optimal Generation Capacity Mix for 2029–2030, CEA estimates the system could achieve 27 GW (108 GWh) of battery storage and 10 GW of PSH by 2029–2030. The IESA has also released projections for energy storage in its 2019 Energy Storage Systems roadmap for the period 2019–2032. The report found that total demand for storage in grid support could reach 17 GWh by 2022 and 212 GWh by 2032. Total demand for storage across all sectors—including electric vehicles and data centers—could exceed 2,700 GWh. Ongoing efforts to better capture the unique features of energy storage technologies in power sector planning models can further inform policy targets for energy storage. NLR is currently combining our flagship capacity expansion model, ReEDS, with a detailed production cost model of the Indian power system to better understand the techno-economic potential for energy storage in India. The results of this forthcoming work will inform where and when utility-scale energy storage is cost-effective and the drivers for energy storage investments.

India has been promoting greater flexibility in the generation fleet in part to facilitate the integration of renewable energy. CERC amended the electricity grid code to lower the minimum generation threshold for thermal generators from 70% to 55%. This change is expected to reduce renewable curtailment from 3.5% to 1.4% nationwide and reduce operating costs by 0.9%. CEA is currently studying the effects of lowering this threshold further to 40%, which could decrease curtailment further to 0.73%.

India is also expanding its ancillary services offerings. POSOCO piloted the use of secondary reserves to provide AGC, which involves changing generators' outputs based on commands from the NLDC. The end goal is to expand AGC to all generating units for secondary reserves. To improve the speed and accuracy of response, POSOCO introduced another pilot in 2019 for fast tertiary ancillary service comprising 20 hydropower generating stations with faster response times than thermal generators. Adding energy storage to the pilot could be beneficial for enhancing flexibility, as several energy storage technologies have comparable or faster response times.

CERC has also written a discussion paper on the creation of a market-based system for its RRAS tertiary response service, which would increase reliability and dispatch speed. Whether through a market or amendments to regulated services, promoting greater operational flexibility through requirements for fast-responding assets improve system reliability. And expanding the range of storage technologies eligible to meet flexibility needs beyond PSH can increase the total amount of fast-responding assets available for balancing.

There are a multitude of initiatives focused on energy storage in India and a general need for greater coordination among the agencies involved. Coordination efforts to advance energy storage deployment are currently driven by industry-led organizations. The IESA is leading these efforts and has several initiatives aimed at disseminating information to catalyze growth in energy storage, including an India Energy Storage Database and Energy Storage Standards Taskforce, as well as targeted training and discussion forums that bring together experts from across the power sector.

The Indian government has several programs to support energy storage, but no central agency is responsible for coordinating these activities. NITI Aayog is the primary arm of the government working on fostering growth in new storage technologies. In parallel, India's Department of Science and Technology has provided research funding for energy storage since 2009. India has also grown its international partnerships to secure more funding for storage research through centers that research the potential for storage to improve grid stability. In addition, the MoP is promoting energy storage pilots through the joint Greening the Grid initiative with USAID and the World Bank is promoting battery storage through its Accelerating Battery Storage for Development program.

With so many separate initiatives, there is a need for greater coordination through the establishment of a government agency or privately led forum. The Association of Renewable Energy Agencies of States (AREAS) could serve as a useful example of what such an entity could look like. AREAS is an MNRE initiative to provide knowledge sharing platform focused on RE where state nodal agencies can "learn from each other's experiences and also share their best practices and knowledge regarding technologies and schemes/programs". In the United States, the state of New York has gone further in creating the New York State Energy Research and Development Authority (NYSERDA), a state agency tasked with, inter alia, promoting the energy storage market. NYSERDA is responsible for allocating state funds to implement storage incentive programs and also serves as the clearinghouse for information on incentives and technical resources for installing and operating energy storage facilities, opportunities for researchers and manufacturers to develop new energy storage technologies, and the state's progress toward its energy goals. NYSERDA also connects technical experts through one-on-one consultations for developers and contractors to help with project siting, sizing, and economics.

New technologies often face a funding gap between research and development and full commercial deployment. This is particularly true for technologies, such as energy storage, that can provide a range of system benefits, some of which are not monetized through existing markets or tariffs. CERC notes that the high cost of setting up a new storage facility poses a barrier for new investments in India.

Existing financial incentives for storage are limited. PSH, the only established storage technology in India, received a recent boost from measures adopted in 2019 declaring large hydropower plants as renewable energy resources. Additional support is proposed in the form of hydropower purchase obligations for these resources. Establishing similar purchase obligations for all storage technologies could be one way to incentivize nascent technologies.

The main way in which non-hydropower storage facilities are being installed is in combination with renewable energy projects. SECI's auctions for solar plus storage installations and round-the-clock renewable power projects have promoted the inclusion of storage as a way to smooth output from renewable energy facilities and reduce curtailment. Extending existing renewable energy financing tools to storage could also encourage its growth. For instance, renewable energy projects, as well as electric vehicles, have access to an accelerated depreciation tax benefit at a higher rate of 40%. Direct assistance of this kind can promote storage projects for a wider range of applications beyond RE integration.

Other support mechanisms could include targeted pilot programs for emerging storage technologies, joint ventures, or special purpose vehicles funded by the Indian government. These have been popular policy approaches in the United States, including Massachusetts's $10 million Advancing Commonwealth Energy Storage competitive grant program and New York's $150 million in funding for utility-scale storage installations under its Market Acceleration Bridge Incentive Program.

Targeted government support can help bridge the funding gap and reduce risk for new storage technologies to reach commercial maturity. Support programs that are technology agnostic, focused on desired capabilities rather than specific technologies, can encourage a wider range of possible storage solutions.

Regulation

India's existing regulations present a useful framework for enabling energy storage deployment; however, current regulations that explicitly restrict storage from providing services or earning revenue for those services present a barrier to maximizing the cost-effective value of storage investments.

Energy storage ownership rules are not clearly defined by CERC. The commission has outlined potential ownership models for transmission, generation, and distribution companies, all for different purposes. Under this scheme, transmission-owned storage would be able to provide multiple services, including renewables integration by firming renewable energy output, peak demand management, congestion relief, and providing frequency or voltage support. Transmission operators could recover storage costs through transmission charges, but they would not be allowed to lay claim to the actual energy stored within the system. For generator-owned storage assets, the costs could be recovered by including the tariff from the storage component in the total annual fixed charges or issuing a supplemental charge for the times of year when the storage is in use. Alternatively, the generator could sell power in the market as an energy arbitrage resource. Distribution companies would be allowed to own storage for the purposes of reliability, sale of power to other generators, or demand management.

Formalizing the roles and ownership models for energy storage investments from different segments of the power sector through CERC regulations can reduce uncertainty for investors.

CERC regulations allow for the connection of storage both as a stand-alone asset and in combination with renewables in hybrid projects. As part of a hybrid project, applications for interconnection are based on the aggregate power supplied by the project. For stand-alone storage facilities greater than 50 MW, applications for connectivity are based on the larger of the intended maximum injection or maximum withdrawal amount and these facilities must sign separate agreements for injection and withdrawal. Stand-alone storage projects under 50 MW can apply for interconnection if they are operated in aggregate. CEA has also amended its Technical standards for Connectivity to the Grid, enabling storage devices as well as charging infrastructure to be connected to the grid.

These regulations support a range of possible storage solutions, including mechanical, electrochemical, and thermal storage technologies. Additional steps could further expedite interconnection approvals for energy storage projects. For example, publishing a network map of preferred storage locations or allowing expedited approval for projects with low anticipated negative impacts on the grid can incentivize storage investments in areas that support the grid.

In a 2017 staff paper, CERC asserted that establishing proper "safety standards and procedures" are necessary for storage to be deployed. The Bureau of Indian Standards is now pursuing this task through is Energy Storage Sectional Committee. The committee's efforts are focused on standardization in the field of grid integration of electrical energy storage systems. The IESA is actively involved in this area as a member of the Bureau of Indian Standards committee and also through a collaboration with UL to create an Energy Storage Standards Taskforce. The taskforce is working on raising awareness on the standards development process, identifying gaps in existing standards, and serving as a leader in forming new standards to fill these gaps.

As interest in energy storage technologies in India grows, increased education, training, and technical support for the development of new codes, standards, and regulations will be critical for the safe and timely deployment of these technologies.

The need for fast-responding assets and power system flexibility has taken on increased importance as the share of variable generation has grown in India. Existing provisions of CEA Technical Standards for Construction of Electrical Plant and Electrical lines requires thermal generators to be capable of providing 3%–5% per minute ramp rate, while the Indian Electricity Grid Code recommends 1% per minute or as per manufacturer's limits. The actual performance of the thermal generators has not met the 3%–5% requirement by CEA. Block-wise ramp rates declared to the system operator for scheduling purposes are generally in the range of 1%. To incentivize generators to provide more ramping capability, CERC updated its tariff to provide financial incentives for generators to provide ramping capability beyond the 1% and to penalties to those that fail to provide 1% ramping. The incentive would increase or decrease the allowed rate or return on equity for generators whose tariff is determined by CERC.

Other regulatory efforts to increase fast-moving assets have focused on ancillary service requirements. India's ancillary services sector is still in the development phase. The following table summarizes the various ancillary service products proposed by CERC.

| Inertial | Primary | Secondary | Fast Tertiary | Slow Tertiary | |

|---|---|---|---|---|---|

| Response Time | Seconds | Seconds–5 min | 30 s–15 min | 5–30 min | >15–60 min |

| Quantum | ~10 GW/Hz | ~4 GW | ~4 GW | ~1 GW | ~8–9 GW |

| Territory | Local | Local | NLDC/RLDC | NLDC | NLDC/SLDC |

| Control | Automatic | Automatic | Automatic | Manual | Manual |

| Code/Order | IEGC/CEA Standard | IEGC/CEA Standard | Roadmap on Reserves | Ancillary Regulations | Ancillary Regulations |

| Status | Existing | Partly Existing | Pilot | Pilot | Existing |

| Note: Table adapted from CERC 2018a | |||||

Inertial and primary response requirements are set out in the Indian Electricity Grid Code and CEA Technical Standards for Connectivity to the Grid. Generators are required to provide these services but are not explicitly compensated for doing so. Actual primary response has been lower than desired at times due to technical difficulties for units to respond in time and some generators not retaining adequate capacity on reserve.

Secondary response and fast tertiary response are both in the pilot phase and have not been fully implemented. Secondary reserves are met through AGC connected to generating units and controlled centrally. CERC has ordered further upgrades to equip units with AGC and set up communication between the control room and generating units to fully implement AGC response. Fast tertiary response is being piloted for hydropower projects under a CERC Order but this service has not been formalized in CERC regulations.

Finally, slow tertiary reserves, also referred to as RRAS, are provided by unscheduled capacity from inter-state generating stations and compensated through variable and fixed charges as outlined in CERC's Ancillary Services Operations Regulations. Any imbalance between supply and demand is managed by dispatching RRAS. Similar to primary reserves, POSOCO has reported that actual RRAS available have been insufficient during some peak demand periods.

Despite recent advances promoting fast-responding ancillary services, two key barriers remain to achieving the desired amount of system flexibility. First, CERC has yet to mandate the amount of reserves required for each service. The 2015 "Roadmap to Operationalise Reserves in the Country" presents guidelines on reserve requirements but these have not been formalized. Second, current regulations exclude certain technologies from providing reserve services, including energy storage. In the 2020 review of the Indian Electricity Grid Code, the Expert Group recommended current ancillary services regulations be expanded to include energy storage technologies.

Updating current regulations to signal the desired amount of ancillary services required to maintain reliable power supplies can signal investment needs among project developers. And expanding the range of technologies eligible to provide these services to include energy storage technologies can increase the amount of fast-responding assets available to meet these needs.

Pricing mechanisms in India are increasingly capturing the value of different services to the grid. This is an important step toward incentivizing investments in technologies that best fit the needs of the system. For instance, wholesale market prices reflect the value of energy at different times and locations, indicating potential opportunities for energy arbitrage and peak demand management services. However, these opportunities are limited, as wholesale markets account for less than 10% of energy sales.

Recent tariff updates by CERC are improving the price signals from regulated tariffs to value generator availability. To improve system adequacy, CERC updated the fixed cost component of the tariff for pumped hydropower and thermal plants to include a capacity charge based on generator availability during high demand periods. PSH plants are required to pump water to an upper reservoir during off-peak hours and maximize available supplies during peak hours to receive capacity payments each day. For thermal plants, capacity payments are higher for peak hours and high demand months. Both of these approaches encourage generating units to be available when most needed (i.e., during high demand periods). To further incentivize greater reliability, thermal generators can earn an additional payment of Rs 0.65 per kWh for energy scheduled during peak hours and Rs 0.50 per kWh for energy scheduled during off-peak hours in excess of the normative annual plant load factor. Expanding these pricing mechanisms to be technology-agnostic could encourage greater availability and performance of the entire generation fleet.

Tariff reforms for ancillary services could also improve system performance. Ancillary services are currently provided from uncommitted centrally-owned thermal and hydropower plants. These units are dispatched based on merit-order criteria, favoring those low operating costs. However, these criteria and the payments for providing ancillary services do not consider the speed and accuracy with which these resources respond. Updating the price signals to reward fast-ramping resources, such as energy storage, could lower total ancillary service requirements.

Under existing regulations, stand-alone energy storage facilities are allowed to compete as a grid-connected entity to provide energy through cost-of-service regulation or within India's power exchanges. However, current market and operating rules—designed for conventional grid assets—fail to capture the operational value and limitations of energy storage technologies (i.e., speed and accuracy of response, state-of-charge, duration). Energy storage can also provide grid support during outages and reduce variability in renewable energy generation for paired renewable energy-plus-storage systems.

Other services are restricted either explicitly by current regulations or due to a lack of compensation mechanisms. For example, energy storage is not considered a "generating station" and, as a result, cannot provide ancillary services or contribute toward India's resource adequacy requirements. Other services, such as improving power quality and reducing RE losses, are technically allowed for stand-alone storage facilities but are not economic under existing compensation mechanisms. Storage as part of hybrid projects can be used to reduce variability of power output and provide firm power, but there is no direct payment for these services.

Increasing access to multiple revenue streams can improve the economic viability of energy storage investments.

There are limited mechanisms for stand-alone storage projects in India to receive revenue. Compensation is primarily earned through long-term cost-of-service agreements directly related to the provision of power; however, this revenue may be insufficient to fully cover the costs of an energy storage facility.

There are multiple existing revenue streams that could be expanded to include energy storage. For instance, India's availability-based tariff compensates generators that can respond to changes in net load to maintain a balance of supply and demand. Energy storage, with its ability to rapidly respond to control signals to inject or withdraw power, could improve system operations and earn revenue through availability-based tariff payments. Frequency regulation presents another potential revenue source for energy storage. Generators that provide RRAS can earn additional payments in addition to their energy charges. Under current regulations, only thermal and hydropower plants can provide RRAS. Expanding the range of technologies eligible to provide ancillary services to include energy storage could improve the financial viability of storage projects and improve overall grid performance. For other benefits, new mechanisms are required to value the services that energy storage can provide and compensate owners for these services.

A related issue is how energy storage resources that provide multiple use applications can or should be compensated through both cost-based and market-based mechanisms. CERC's proposed guidelines involve separate service charges for each service energy storage provided at its time of use. For instance, if the storage capacity is sold to other generators, the costs could be recovered with a markup price based on the cost of energy during the charging, holding, and discharging periods. If storage is used for voltage control or congestion reduction, costs can first be recovered from the reactive pool account or reliability charges. Further work is needed to define how to combine multiple revenue streams without resulting in double recovery of costs or distorting market outcomes.

Learn More

What Is the Energy Storage Readiness Assessment?

The energy storage readiness assessment is a simple evaluation tool developed by NLR to identify barriers and opportunities for storage within a given power system and policy and regulatory environment. It is designed to help decision makers identify priority areas for focus as they develop the appropriate suites of policies, programs, and regulations for energy storage. Learn more about the energy storage readiness assessment.

Conduct Your Own Readiness Assessment

Download the Energy Storage Readiness Assessment workbook.

Share

Last Updated Dec. 7, 2025