Industrial Sector Module

This Stochastic Energy Deployment System (SEDS) module represents the U. S. manufacturing sector, to which the rest of the industrial sector will be added. It's a prototypical engineering-economic model with energy tied explicitly to output produced and the technologies used to produce that output.

There is a hierarchy of technologies that begin with the basic provision of end-use services—process heat, process cooling and refrigeration, electro-chemical processing, and other process requirements. These processes then require a variety of auxiliary services such as conveyance, pumping, steam, etc. Just as with the end-use service equipment, these auxiliary services compete on the basis of costs to satisfy requirements needed by the major end-use services for the production of manufacturing goods.

As output grows over time, energy use and emissions will change, depending on the available technology and the market penetration of the more efficient technologies and growth rate of output requirements. The model is capable of incorporating learning-by-doing, so that as new technologies penetrate, their cost decline somewhat.

Focus of Analysis

The industrial sector module is capable of simulating alternative scenarios of energy prices, the introduction of new technology, carbon taxes, and investment tax credits for more energy-efficient investments. These scenarios can be simulated individually or together to evaluate their effects on energy use in the industrial sector, emission of carbon dioxide (CO2) and other criteria pollutants, and the penetration of the stock of new technologies.

Limitations of Analyses

This module is a representation of the U. S. Manufacturing sector. Thus, it is both national in scope and lacks both regional and industry detail. The model is currently incapable of describing the introduction of a major new industry-specific technology, such as an innovative substitute for the electric-arc furnace used in steelmaking, or a energy-saving option for the firing of black liquor in the pulp industry. With back-of-the-envelope calculations, the major end-use requirements might be altered to reflect these technology introductions, but in the current version they would lack credibility.

Unfortunately, it also limits the amount of analysis that can be done on technology deployment and implementation of policies directed toward specific processes.

Technologies of Interest to U.S. Department of Energy

While the major end-use services are not strictly "technologies," the auxiliary services that are required by these major end-use services include pumps, fans, compressors, conveyors, motors, lighting, and boilers.

Overview of Methodology

The methodology allows for adoption of cutting-edge technologies without going into all of the detail of specific equipment.

The model is a typical engineering-economic model of the industrial sector with output, energy use, and technology stocks calibrated to Manufacturing Energy Consumption Survey (MECS) data for 2002, then simulated and benchmarked to 2005 Annual Energy Output (AEO). The model is initialized by balancing three items: output levels of goods produced, energy used by fuel types, and known process technologies. As it simulates from this initial period onward, it uses a forecast output level as a driver, then produces that level of output using what remains of the initial level of stock along with additions to the stock as required to satisfy the forecast.

Separate vintages of stock are tracked, so that each vintage retires subject to expected economic lives. When new stock needs to be introduced, the model calculates how much is needed based on the level of output that is required less the current stock available after old stock has been retired. That new stock is purchased using a market share calculation that compares different efficiencies of stock and their costs.

As output for the sector grows over time and the calibrated stock of equipment retires there is need to add new stock. These additions are selected from among equipment stocks of different efficiencies, with more efficient equipment having higher capital costs. These various types of equipment compete based on the relative cost of each type of equipment relative to the average cost for all equipment. This market share calculation includes capital costs, operating and maintenance costs, and fuel costs, which depend of the rate at which the fuel is used and the price of fuels. This market share calculation reflects a probabilistic cost minimization process, with overlapping distributions of technology costs determining the point at which costs are minimized.

The aggregate module is currently structured to include four major process end-uses, similar to the major process end-uses reported by MECS:

- Process heating

- Process cooling and refrigeration

- Electro-chemical processes

- Other process requirements.

Each of these is assumed to have three different levels of efficiency: the current average efficient stock, a state-of-the-art, and an advanced technology. The state-of-the-art is competitive with the current average stock immediately. The advanced technology becomes available to compete with these two in 2025.

For process heating and other process requirements, there will be a variety of these technologies depending on the fuel used to fire them. The electro-chemical processes are dominated by electricity use while the process cooling and refrigeration can use either electricity or natural gas adsorption cooling. The technological realism comes not at this level, but at the next level down, where auxiliary services are required by each of these end uses.

Auxiliary Services

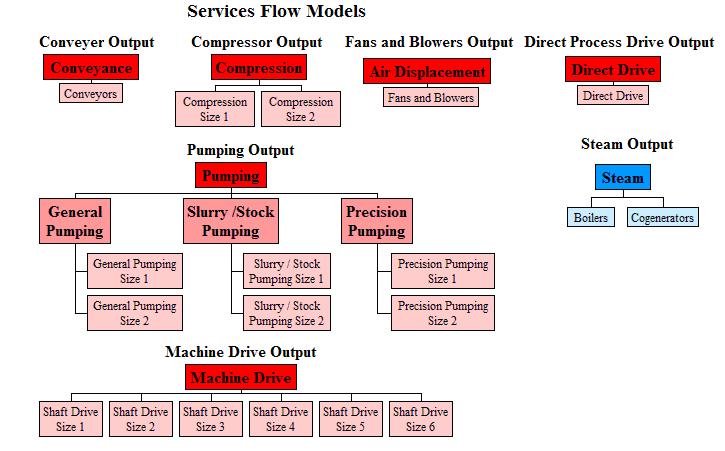

The auxiliary services included in the module are shown below in Figure 1.

Figure 1. Auxiliary equipment classes

In Figure 1 above, the brighter red boxes show the class of equipment, such as compressors, while the lightest pink show the nodes where different efficiencies of equipment compete to satisfy service demand. In the case of pumps, there are three classes of pumps depending on their use. This differentiation is important for capturing the variety of pumping services that different industries require. Steam can be supplied by either boilers or combined heat and power (cogenerators) with a variety of fuels used to fire these two options.

Capital costs, fixed and variable operation and maintenance costs, emissions costs, fuel costs, tax incentives, and the expected utilization rates are used to calculate the levelized annual total cost for each technology. Capital costs can be decreased by R&D and learning. The effects of R&D are treated with uncertainty and can be adjusted to try to capture the level of government investment in R&D. Improvements from learning are based on cumulative installed capacity, such that a specified percent improvement in capital costs is achieved for each doubling of capacity. CO2 emissions costs are applied to all fossil fuel technologies when a carbon tax is imposed. Production tax credits, investment tax credits, and accelerated depreciation can be applied to appropriate technologies and will lead to lower levelized annual costs. The combination of all these factors produces a levelized annual cost of auxiliary services that is used to determine how the market share of new capacity additions will be given to the competing technologies.

Two logits are used to assign a share of the demand growth to the competing technologies. The first logit computes an unconstrained market share based purely on the technologies' levelized costs. The resulting unconstrained capacity additions for each technology are then compared to the average of the additions from the past three periods. If the unconstrained additions are greater than the average additions, then a damping factor is applied. The damping factor is a function of the ratio of unconstrained additions to average additions, so as the ratio increases so too does the damping. This damping factor is intended to prevent rapid and unrealistic growth of technologies, especially nascent technologies. The second logit computes a damped market share using a utility for each technology that has been multiplied by its corresponding damping factor. It is this second logit that determines the actual share of new capacity additions for each technology.

The damped market share is then multiplied by the projected amount of new demand to assign a market share for each technology. Finally, these new additions are added to the existing stock of equipment minus that time period's retirements. The resulting stock then matches demand.

Once the stock of equipment has been changed to reflect additions and retirements, fuel use is calculated. This leads to a CO2 emissions calculation that is determined by the carbon content of each fuel and the amount of fuel combusted.

Major Assumptions

Capital costs, operating and maintenance costs, and performance characteristics for all the auxiliary equipment are drawn from the CIMS-US database, and are currently being updated. The major end-use categories that were defined are gross representations of averages of equipment contained in the CIMS database, but themselves have no real-world technology equivalent. Where special studies have been conducted, the parameter for the logit function is used; otherwise, we use a parameter that follows the rule-of-thumb that a 15% cost differential captures 80% of the new market share.

Portfolio Decision Support Inputs

The Industrial Technology Program (ITP) has responsibility for technology development and the assessment of impacts of the energy savings as a result of ITP-developed technologies. The portfolio decision support (PDS) process has experts collect detailed information on the likely consequences of technology development with this data submitted to a rigorous spreadsheet analysis that classifies technologies as falling into classes with known penetration rates. In prior years, there have been as many as 82 of these multi-tabbed spreadsheets that are then aggregated to yield estimates of energy savings by program area, then for all ITP programs. The basic input data are at a highly disaggregated level, such as "Millisecond Oxidation of Alkenes," so would affect only a small segment of the chemical industry, at least initially.

At the current implementation of the SEDS industrial sector, the aggregate numbers can be implemented into the model by altering the out-year efficiency of particular technology to reflect the energy savings estimated by ITP.

A subset of 52 distributions was divided into groups based on what end-use was addressed by each technology. Twelve of the distributions were constructed by ITP based on the expert inputs, 40 additional distributions were developed using these estimates.

For each end-use type (Other Processes, Process Heating and Boilers) individual technology distributions were combined into one distribution for each of 3 budget cases (Base Case, Target and Overtarget) for three goal years (2015, 2020, and 2025) and 3 fuel types (electricity, natural gas and coal). Based on the description in ITP information sheets the PDS data was applied only to the advanced set of technologies. Since the PDS data was initially constructed for fuel intensity improvements in specific technologies, but SEDS treats energy demand on the basis of associated end-uses across the whole industrial sector, technology-specific distributions had to be scaled down to match the magnitude of average intensities modeled in SEDS.

Stochastic Inputs

There are a number of stochastic inputs for the industrial sector that can be broadly described in five categories:

- Policy

- Costs

- Performance

- Date of availability

- Adoption behavior.

Two major policies will impact industrial energy use over time: investment tax credits (targeting energy-efficient investment) and R&D that will affect the availability of more efficient technology in the future. A third policy instrument, carbon policies that impact the price of fuels, will also affect the industrial sector, but since these policies are reflected in the price of fuels, they should be implemented outside this particular end-use sector.

Costs of new equipment are a major source of uncertainty in the industrial sector. The focus here is on capital costs, with ranges reflecting a probability distribution that has an inverted V shape. The range that this probability distribution covers will be determined by the currently ongoing updating of data for the industrial sector. Our sampling of suppliers is expected to show some variation in the price of equipment that we will convert into a distribution. The other stochastic element related to costs is the learning curve associated with capital cost reductions over time. While the model would allow stochastic representations of all the technology costs within the industrial sector, it is more likely that these stochastic inputs will only be defined for those classes of technology to which PDS applies.

The performance of the equipment is also critical to the adoption of new technology. Again, as with costs, we expect the current updating of data for the industrial sector to provide some insight into the range of possible performance for major classes of equipment. While the model would allow stochastic representations of all the performance parameters within the industrial sector, it is more likely that these stochastic inputs will only be defined for those classes of technology to which PDS applies.

For the current version of the industrial sector, the major end-uses have availability dates that are deterministic—the state-of-the-art becomes competitive in 2005, the advanced technologies become available in 2025. A higher R&D budget would surely expedite the date at which the advanced technologies would become available or maybe even add a new class of technologies that were more efficient than those currently defined. So, two immediate options for stochastic dates of availability come to mind: one is simply a distribution around the available date; the other is a distribution that is affected by R&D budgets.

The parameter that determines the fraction of the market a particular cost advantage would capture is also capable of being defined stochastically. Currently, the rule-of-thumb dictates that a 15% cost differential captures 80% of the market. If one uses an inverse power function for this calculation, the parameter that would yield this market share for this cost advantage is 10. If instead a 7 is used, the technology would require a 20% cost differential to capture that same 80% of the market. Alternatively, a parameter of 14 would capture an 80% market share with only a 10% cost advantage. Barring specific evidence on technology adoption, such a range would seem reasonable.

Key Inputs from Other Modules

- Fuel Prices: coal, diesel, residual fuel, natural gas, electricity and possibly bio-fuels

- The growth rate of manufacturing activity (alternatively, the industrial sector)

- Industry applicable discount rates

- Industry applicable interest rates (say the prime rate)

- Applicable investment tax credits.

Key Outputs to Other Modules

- Fuel Use: coal, diesel, residual fuel, natural gas, and electricity

- Major emissions: carbon dioxide, possibly others

- Cost of investment in new plant and equipment

Other Information

This version of the industrial sector of SEDS was constructed from an aggregate model of the U.S. manufacturing sector developed as a sector of the CIMS-US model. CIMS-US is an integrated economic model of the energy produced and used in the United States.

This model was developed in conjunction with the Energy and Materials Research Group at Simon Fraser University, British Columbia, Canada. For more information about the model, visit the Simon Fraser University website.

Calibration to Manufacturing Energy Consumption Survey 2006

The model has been recalibrated to match energy demand shown in MECS 2006 for manufacturing and non-fuel (feedstock) use. The difference between MECS data and AEO totals was included in the module as Non-Manufacturing Fuel use.

For detailed description of the calibration, please see Reconciling Industrial Energy Use to MECS. For step-by-step reconciliation with AEO, see the Final Calibration to AEO spreadsheet.

Attachments

SEDS - Industrial Sector, Pacific Northwest National Laboratory:

Industrial Sector in a Stochastic Energy Model Abstract

Authors

Joe Roop, Pacific Northwest National Laboratory

Olga Livingston, Pacific Northwest National Laboratory

Share

Last Updated April 21, 2025